MERGERS, ACQUISITIONS AND ... TOO BIG TO FAIL? A POSSIBLE FUTURE FOR THE ANGOLAN BANKING SECTOR

THE TOO BIG TO FAIL RISK

Due to BNA Notice No.

02/18 on the adequacy of minimum social capital and regulatory capital

of banks, which requires their increase, there has been much speculation

about the possibility of a wave of mergers and acquisitions (mainly

mergers) in the near future of the angolan banking subsector. However,

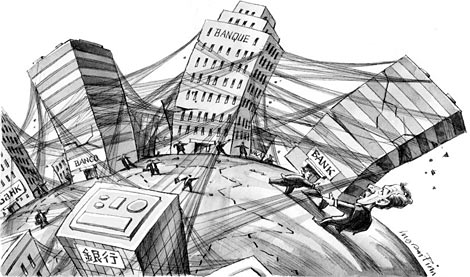

little or nothing has been mentioned about the risk of it resulting in

potentially large Banks that could represent massive systemic risks: the

Too Big to Fail.

A Too Big to Fail bank, is a banking institution

whose size and influence on the economic system, would be so

significant that if it became insolvent, the economy would suffer

severely. Bank size, complexity and interconnection with other banks may

inhibit the Government's ability to resolve the bank without

significant disruption to the financial system or the economy (see the

subprime crisis in 2008, where the fall of Lehman Brothers triggered the

recent global financial crisis and whose consequences are still felt).

The risk of bankruptcy of a “Too Big to Fail” increases the probability

of a bailout by the Government, which often means, as we have seen in

other realities, times of austerity. It should be recalled that in the

case of Angola, although the Deposit Guarantee Fund has recently been

materialized under Presidential Decree No. 195/18 of August 22nd (which

is positive), the Resolution Fund has not (at least not yet), which

makes our financial system still vulnerable in case a Too Big to Fail

institution needs to be "rescued".

These Too Big to Fail banks

may arise amongst us if these operations are not closely monitored (and

very cautiously) by the regulator. And as experiences of other realities

have already demonstrated, institutions of this nature can have

devastating effects on the financial system, which should preferably be

avoided.

If the risk of this scenario becomes significant, the

regulator may, as a preventive measure, intervene and mediate these

M&A operations, in order to ensure that one or more institutions

will not take on the risk of converting them into risk centers,

potentially unbearable for the financial system.

Such

intervention may also involve, if necessary, the creation of new

regulatory instruments aimed at limiting the ability of banking

financial institutions to concentrate their risk; impose new capital

requirements (again) which may even be progressive in nature; the

creation of a category of "systemically relevant financial

institutions"; the establishment of specific and more stringent

continuous monitoring mechanisms; oblige banking institutions to develop

mechanisms that enable them to quickly liquidate assets in the event of

insolvency; the development of a complex structure of settlement and

deposit-guarantee mechanisms so that, in the event of insolvency

(whether it is a Too Big to Fail or not), it serves as a buffer against

the impact on the financial system; and the creation of communication

channels that facilitate a direct consultation with the regulator, in

what concerns to matters that can influence the systemic risk that these

institutions represent.

In this approach, the fundamental

concern will be the definition of frameworks that guarantee the

economic-financial equilibrium of institutions, preventing (or

controlling) their involvement in other entities whose eventual collapse

could have a negative repercussion on the participants themselves and,

in a more comprehensive plan, in the national economy, through the

so-called domino effect.

As we can see, the intervention of the

regulator is necessary to ensure the stability of the financial system

during and after the completion of these merger and acquisition

operations that may (and most likely will) reconfigure our financial

system and, in particular, the banking subsector.

THE SUBPRIME CRISIS

In

conclusion, it is worth recalling, very briefly, the origins of the

2008 financial crisis, which serves as a reminder of the risks of Too

Big to Fail institutions.

This resulted from market failures and regulatory failures.

The

market failure occurred because wealth (or capital) holders did not, in

many cases, take the necessary precautions to protect their interests.

Several companies established compensation structures that rewarded

excessive risk.

Banks "bought mortgages", even with the knowledge that the criteria for granting housing loans were not very strict.

At

the same time, several regulators (recalling that this had

international proportions and occurred in a number of markets) took on

"more relaxed" postures in the performance of their duties, despite the

alerts by a number of experts about the risk of a crisis with the same

nature of the crisis of 2008 (some date back to the 1990s). As noted,

such alerts were ignored.

Originally published in 05/10/2018 on Jornal Mercado.

Elaborated by: Elvis Barros

Comentários

Enviar um comentário